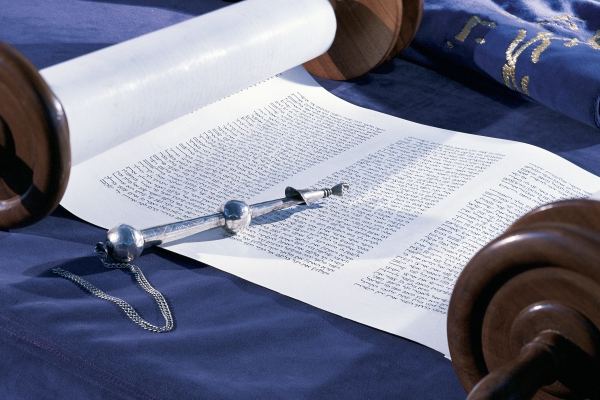

Parashat Ki Teitzei is a treasury of Jewish legal and ethical literature. I would guess that more pages of the Talmud are devoted to the discussion of verses from this parashah than any other in the Torah. Many basic principles of marriage law and of civil law find their sources here — generally in verses that are by no means self-explanatory but require extensive discussion, interpretation, and application. The parashah is truly an embarrassment of riches that makes selection of a single topic very difficult.

Yet a decision has to be made, and I will focus on two verses regarding laws of borrowing and lending, and their subsequent development:

“When you make a loan of any sort to your compatriot, you must not enter the house to seize the pledge. You must remain outside, while the person to whom you made the loan brings the pledge out to you” (Deuteronomy 24:10–11). Let us unpack these verses and their development in the Jewish legal tradition.

As in many legal systems including our own, loans made under Jewish law frequently required the borrower to designate an item of value as security (biblical Hebrew: avot, Rabbinic and modern Hebrew: mashkon). The accepted practice was that the designated security could remain in the possession of the borrower during the term of the loan. If the money owed was not repaid upon the designated date for repayment, the creditor had the right to take possession of the security. Frequently, the creditor would hold onto it for another fixed period to give the borrower the opportunity for repayment and restoration of the item. Biblical law asserts that the creditor has no right to enter the borrower’s home in order to seize the pledge that he has the right to possess; the debtor himself must produce it.1

The problem is obvious: What if the borrower refuses to produce the security pledge? What if he claims that he has lost or sold it or used it for another loan, and that it has already been taken and he has nothing of value to give over to the creditor? The biblical law explicitly prohibits the creditor from entering the house to investigate, but may a neutral emissary of the court enter the borrower’s domain? The law of the Talmud clarifies this ambiguity by stating “no”: even the emissary of the court must remain outside. If the creditor believes that the borrower is lying and that he does indeed have property of value in his house, or concealed somewhere else, the creditor has the burden of proof, in accordance with the general principle, hamotzi meicḥavero alav hara-ayah, “the burden of proof lies with the person who seeks to remove property from the possession of his neighbor.”

Apparently, this legislation protected the rights of the borrower to such an extent that the result was a credit squeeze. Potential borrowers who needed loans were simply unable to find people willing to lend under these circumstances (the loan of course had to be without interest: see Deuteronomy 23:20). Biblical and Rabbinic legislation intended to help the borrower seemed to have the opposite effect. Therefore, in order to free up the credit market, the gaonim, heads of Babylonian academies in the post-Talmudic age, enacted new legislation: the debtor who does not repay on time and claims he no longer has the security pledge is to be subjected to a strict oath that he has no property concealed, and if he is seen holding any property of value, the burden of proof shifts to the debtor, who must prove that this property does not belong to him.

The great legal scholar Moses Maimonides, whose Code of Jewish law records this fascinating post-Talmudic development in response to changing economic circumstances, continues to write, “Even now, after the above regulation has been enacted, neither the creditor nor the court’s representative may enter the debtor’s house for the purpose of enforcing distraint, since the enactment was not intended to abolish an essential rule of the Law. The debtor himself must bring out his movables and say ‘This is what I have’ ” (Mishneh Torah, “Laws of Creditor and Debtor,” 2,2).

And, after fully recording the new legislation of the gaonim, Maimonides continues to present his own clarification: this rigorous oath should not be imposed by a judge upon debtor who is known to be so pious that he would refuse to swear such an oath lest he might have forgotten an asset from years ago nor should it be imposed upon a debtor who is known to be so dishonest that he would readily swear to something he knows to be untrue. Maimonides’ conclusion leaves considerable discretion to the judge: “Everything the judge does in these matters with the intention of pursuing justice only and not of tampering with the Law to the detriment of one of the litigants, he is permitted to do, and he will receive heavenly reward for it” (Mishneh Torah, “Laws of Creditor and Debtor,” 2,4).1 But some later authorities wrote that this final statement applies only in an environment where the judges are honest and reliable, not if the judges themselves are under suspicion.

Here we have an example that beautifully illustrates the principles of Progressive Judaism. Despite the claims of fundamentalists, Jewish law has not remained static and unchanging from the Revelation at Mount Sinai to the present. It has developed dynamically and adapted in accordance with the wisdom of the Sages and the medieval authorities in response to their perception of the needs of their times. Yet there are limits to such changes: basic, fundamental principles rooted in the Torah must still be honored. Both the creditor and the emissary of the court must still remain outside the debtor’s home.

This may well be the source of the familiar principle in British law that “a man’s home is his castle.” The statement has been used by right-wing thinkers to defend some rather unappealing conclusions: that a man has the right within his home to beat his wife and his children without any interference from the legal authorities. But the biblical source shows that a very different meaning was intended: a defense of the dignity of even the most humble human being facing potentially humiliating circumstances. As formulated by William Pitt the Elder, “The poorest man may in his cottage bid defiance to all the forces of the Crown. It [the cottage] may be frail — its roof may shake — the wind may blow through it — the storm may enter – the rain may enter – but the King of England may not enter” unless invited. And certainly, neither can the President of the United States or the creditor seeking repayment.

1. Maimonides’ full discussion of this matter can be readily found in Isadore Twersky, A Maimonides Reader (New York: Behrman House, 1972), pp. 183-186, based on the translation in The Code of Maimonides, Book 13 (Yale University Press, 1963)

Rabbi Professor Marc Saperstein, after having taught Jewish Studies at American universities for 29 years (Harvard, Washington University in St. Louis, George Washington University in D.C.), relocated in 2006 to England for a five-year term as Principal of Leo Baeck College. His recently completed book, Agony in the Pulpit: Jewish Preaching in Response to Nazi Persecution and Mass Murder, will be published by Hebrew Union College Press.

Rabbi Marc Saperstein has gone into tremendous and important detail regarding the rights of both the borrower and the lender through Jewish tradition and its relevance to Progressive Judaism. And, as we know these verses from Parashat Ki Teitzei are still incredibly relevant to us today.

In looking at the concept of borrowing and lending, I cannot help but reflect on the housing lending crises the US experienced 2007-2010. In this case, banks lent money to people based on future income growth, with little to no deposit. I may be oversimplifying the issue, but ultimately, people borrowed more than they could afford, banks lent money without security and then the market went into a recession. The result was catastrophic for so many people who lost their jobs, their homes and in many cases their self-worth.

For me, the question lies in the ethical responsibility incumbent on both the borrower and the lender. While a lender may not enter a home (Deuteronomy 24:10–11). to demand payment, a borrower should not hide from his or her responsibility either.

My congregation, like so many, continuously works with members who genuinely cannot afford their membership dues. To avoid a member going ‘into debt’ to a congregation, it is so very important for there to be open and continuous communication between members and the shul.

In cases when membership debt increases, it causes embarrassment to the member, along with a sense of frustration for the congregation. Congregations, I believe work to their best, with unpaid membership dues, to help members find a balance between being part of communal life and valued members of their congregation, along with a sense of commitment, whether through financial (according to means) or volunteerism to the congregation. In both cases, the integrity of the congregation and the member must be maintained. Compassion and communication needs to be at the core of a congregation’s response to members who are in financial need, yet at the same time, the member must also realize that congregations rely partly on membership income to survive. I don’t believe that any congregation wants the financial arrangement to define a member’s relationship to the congregation.

Rabbi Kim Ettlinger is rabbi of religious life and education at Temple Beth Israel in Melbourne, Australia.

Ki Teitzei, Deuteronomy 21:10–25:19

The Torah: A Modern Commentary, pp. 1,483–1,508; Revised Edition, pp. 1,320–1,344

The Torah: A Women’s Commentary, pp. 1,165–1,190

Fifth Haftarah of Consolation, Isaiah 54:1–10

The Torah: A Modern Commentary, pp. 1,612–1,613; Revised Edition, pp. 1,345–1,346

Explore Jewish Life and Get Inspired

Subscribe for Emails