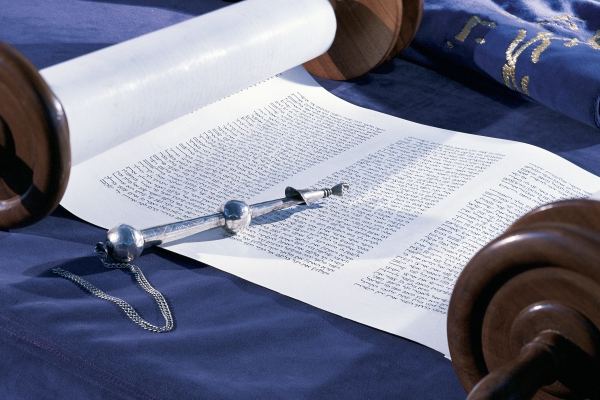

“When you acquire an eved Ivri, Israelite debt servant, that person shall serve six years – and shall go free in the seventh year, without payment” (Exodus 21:2).

Parashat Mishpatim begins with commandments governing the relationship between an Israelite master and eved Ivri, a fellow Hebrew who has defaulted on a loan and therefore must work off the debt. For modern Jews, it is jarring to read about Israelites enslaving others so soon after God freed them from Egyptian slavery.

From antiquity to the present day, debt has been an unavoidable economic necessity for many. It is therefore not surprising that the Torah strives to make borrowing humane by incorporating debt limitations in the social contract of the newly freed Israelites.

To limit the impact of debt, Parashat Mishpatim instructs, “If you lend money to My people, to the poor among you, do not act toward them as a creditor; exact no interest from them” (Exodus 22:24). Echoing the humanity of interest-free loans, a borrower’s cloak could serve as collateral, but it had to be returned at night for sleeping in the cold (Ex. 22: 25-26). For more debt-related laws, see Leviticus 25:35-37 and Deuteronomy 23:20-21 and 24:6, 10-13.

The Torah does not envision owing debt as a perpetual status, even when the borrower fails to repay the loan. An Israelite borrower who is unable to pay off the interest-free loan enters debt servitude; however, if the defaulted loan remains unpaid by the end of the sixth year of service, the servant is released and the debt discharged (Exodus 21:2).

Parashat Mishpatim offers a ritual for the debt servant to abdicate his right to liberation in the seventh year, binding himself to his master forever. When offered his freedom, the debt servant refuses, declaring, “‘I love my master, and my wife and children. I do not wish to go free.’” The master then pierces the servant’s ear and says, “He shall then remain his master’s slave for life” (Exodus 21:5-6). This agreement assumes the master has provided the servant with a wife; the prevalent rabbinic view is that this law only applied to men (Rabbi Dr. Rachel Adler, Torah: A Women’s Commentary, 447-448). Yet, it is not clear if it applied to single men.

In the view of 13th-century Spanish commentator Rabbi Bahya ben Asher, the law was driven by compassion, as it allowed the family unit to remain intact, albeit in servitude (Rabbeinu Bahya on Exodus 21:5). However, I would like to suggest an additional reason. Perhaps, the debt servant refused to leave the master when faced with the daunting financial insecurity he would face in independence. This ritual also reveals the plight of poverty that has plagued generations to our very day.

According to the New York Federal Reserve, Americans hold a startling $14.6 trillion in consumer debt, including mortgages, home equity credit, student debt, auto loans, and credit cards. For many, debt has become an inescapable trap, a form of bondage.

A recent New York Times article reported that “more than 43 million [American] borrowers hold over $1.6 trillion in student loans, a sum that has more than tripled in 13 years.” Student loans can be particularly problematic because unlike other debts, they cannot be discharged in bankruptcy court. In addition, young borrowers often do not have a complete understanding of how this debt load can weigh down their lives for decades, sometimes beyond retirement.

This burden is painfully expressed by a rabbi who anonymously shared the struggle to finally pay off student loans:

“I am still amazed by my own naivete taking out student loans for rabbinical school. Thinking the interest rate is less than for a credit card. Thinking ‘I’ll pay the interest while I am still in school.’ Thinking that the loans would be easy to repay since I had repaid loans for college. Not understanding how quickly debt grows. Not understanding how consistently underpaid I would be. Not understanding that student loans are a debt that never goes away or that default could mean the garnishment of my salary.” (The Sacred Exchange: Creating a Jewish Money Ethic, xxix)

Jewish law developed loopholes that allow the charging of interest to other Jews, but the biblical intent has always been to make debt humane. Borrowing is a needed financial tool to respond to emergencies or to create personal and business opportunities. Living in an era of ever-growing debt burdens, we moderns must ensure debt’s impact is limited, rather than enslaving borrowers with predatory interest rates and subprime lending practices, as well as creating a downward economic spiral. As a Jewish community, we must not allow this disheartening burden to create a barrier to full participation in Jewish communal life.

Let us work for a time when unfettered debt no longer robs so many people of a better future, of financial security and freedom.

Explore Jewish Life and Get Inspired

Subscribe for Emails